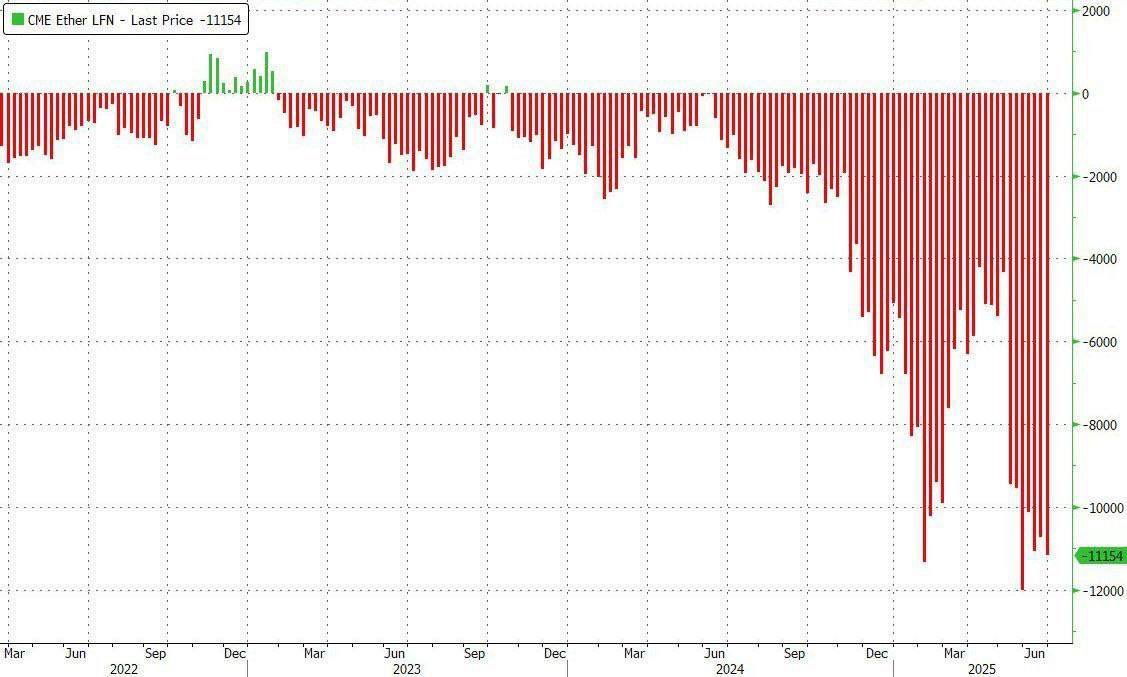

CMEGroup @CMEGroup speculators have taken one of the largest short positions in #Ethereum futures in history since Jan 2025.

@grok: The claim that speculators have taken one of the largest short positions in Ethereum futures on CME Group since January 2025 aligns with reports from early 2025. Specifically, hedge funds and other speculators have been noted to hold significant short positions, with over 22,000 short contracts reported by some sources, driven partly by carry trades and bearish bets. This is supported by posts on X and articles indicating a record short interest, particularly highlighted in February 2025, where carry trades (selling CME Ether futures while buying spot ETFs like ETHA) and outright bearish positions were cited as key drivers.

Insiders and large players might anticipate a price drop or are positioning for a specific event. While possible, the short interest is largely explained by carry trades exploiting the basis between futures and spot prices, not necessarily insider knowledge. However, some outright bearish bets reflect skepticism about Ethereum’s performance compared to other chains like Solana.

Short interest on Ethereum is at historic highs, with $470M in short positions correlating with $480M in ETF inflows. This supports the carry trade narrative but also highlights potential vulnerability to a squeeze if Ethereum’s price rises unexpectedly.

Summary:

- they know something

- hedge funds are implementing the basis trade

- numbers don’t lie

Show original

54.75K

347

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.