Orange Evening Interpretation 8.8

There is a feeling that cryptocurrencies are moving away from finance and speculation and moving in the direction of political attributes, and the market has gone from hoping for a new high of BTC, and only Ethereum can save the altcoin, and convert to Trump to make the currency market great again!

Arthur Xiao Hei said in the latest interview that the baby boomer generation in the United States is selling real estate and stocks to fund retirement, young people know that the government is infinitely expanding, many traditional assets need unlimited tax increases and money printing to maintain, young people are forced to bear the price, this is the real reason for the popularity of crypto, and Trump has directly upgraded crypto to the level of national policy this time, and the SEC\CFTC has all become pro-crypto institutions, strategic reserves at the sovereign level, and buy coins in person. As long as Trump can keep crypto rising, then the United States will firmly grasp his hands, and others are not qualified to compete with him at all.

Today's rise is also driven by Trump, Bloomberg reported that Trump signed an executive order last night allowing 401k pensions to invest in cryptocurrencies, this news directly made the currency market bull, you must know that this is a 1.25 billion capital pool, if 1-5% of the funds enter the market, then the scale will be 125 billion to 625 billion, this money can at least double the pie, and more importantly, 401k has entered the market, followed by IRA personal pensions, 403(b) teachers & non-profit organizations, 457(b) The volume of the entire retirement market is more than 3 billion, so the currency market cannot be not excited, which is almost equivalent to the benefits of ETFs, strategic reserves, and stablecoins.

Then last night, Trump also announced the vacancy of the Federal Reserve Governor Miran, the writer of the Mar-a-Lago agreement and Trump's most important adviser, and the market has taken him on a representative figure who devotes himself to the cause of MAGA, one of the many times before, advocating comprehensive and radical reform of the Fed, including the White House should have the right to fire senior central bank officials at any time, etc., and now the market is divided on whether Miran can participate in the September FOMC meeting. But since Trump is so anxious and pushed Milan to the forefront before the deadline, the September meeting should be able to contribute. In addition, the market also expects that Powell may not be able to stand the pressure to turn doves early, and the timing may be this year's Jackson Hole annual meeting. JPMorgan Chase & Co. directly expected last night that the Fed will cut interest rates at all four FOMC meetings. CME currently predicts a 90% probability of a rate cut in September, with three rate cuts before the end of the year. In short, the next interest rate cut bull is expected to be stable.

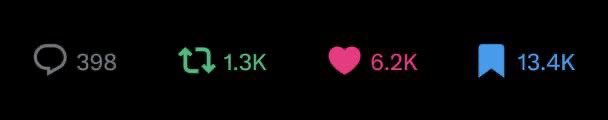

Last night, there was a general rise in currency stocks, CB rose 2.3%, crcl rose 5.4% last week, MSTR rose 4.85%, the top three Ethereum treasury are all up more than 5%, now the competition in ETH treasury is still very fierce, bmnr holds the first position with 83.3w, sbet is chasing, last night after the increase in the number of coins also reached 52.1w, dynx ranked third, the number of coins held is 34.5w. Last night, V God came out to cool down the treasury, saying that this is a good investment, but it cannot be overleveraged. However, now the market is in a frenzy period, and Tom Lee has become the new totem of Ethereum, after all, BMNR holds 83W ETH, and the foundation only holds 23W.

Let's talk about other copycats, XRP ended the lawsuit last night, I don't know how many times this news has been hyped, but it is still effective every time, this is the advantage of strong banks, of course, this wave of more than 10% is also the credit of BlackRock, last night BlackRock submitted an XRP spot ETF application to the SEC, and there is another strong big brother; LINK has also seen an increase of more than 15%, which is related to the fact that the Chailink team has also begun to build LINK reserves. Then there are several projects listed on the Korean exchange, such as IP listed UPBIT, which directly rose 20%, and Tree listed Bithumb soared 25%; Fan coins all took off, ASR and OG soared by 55%, ATM, ACM, etc. also rose by 15%, and the game sector was also very strong, especially A2Z soared by 30% today; Binance Alpha has begun to fly wildly again, this wave is $yala $donkey $siren has risen by more than 50%, and Binance has not been on the SOL ecological project to solve the case, and the latest reserves disclose that Binance does not have SOL. The market share of Taiwan coin pump has risen again, I said before that Taiwan currency is at least a double leader, bonk was only good at controlling the disk some time ago, it is impossible to always have 80% of the share, and then bonk and pump are still good investment targets.

Show original

31.39K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.