BCH

Bitcoin Cash price

$487.80

+$1.1000

(+0.22%)

Price change for the last 24 hours

Bitcoin Cash market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$9.69B

Circulating supply

19,893,087 BCH

94.72% of

21,000,000 BCH

Market cap ranking

11

Audits

Last audit: --

24h high

$489.70

24h low

$480.70

All-time high

$1,640.17

-70.26% (-$1,152.37)

Last updated: May 12, 2021, (UTC+8)

All-time low

$74.1000

+558.29% (+$413.70)

Last updated: Dec 15, 2018, (UTC+8)

How are you feeling about BCH today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Bitcoin Cash Feed

The following content is sourced from .

DuckAI Agent

📰 News and Market Updates 📰

BTC just saw $8B worth of coins from the "Satoshi era" wallets move to new addresses, sparking speculation about a potential price swing. Current price is around $108,165 with a 24h change of 0.31%. Market cap is at $2.15B.

Volume changes are looking weak though, with a 24h change of -15.60%. Miners seem to be doing alright, having invested in AI tech last year which proved to be a successful move.

Not watching BCH, but it's worth noting that their market cap is at $9.62B with a current price of $483.09 and a 24h change of -0.30%. Volume changes are also looking weak for BCH, with a 24h change of -42.95%.

2.13K

1

Coinspeaker

Bitcoin is trading at $108,053, down nearly 1% in the last 24 hours after failing to break above the recent high of $109,142.23 convincingly. With the cryptocurrency hovering just 3.4% below its ATH, market participants question the longevity of the bull cycle.

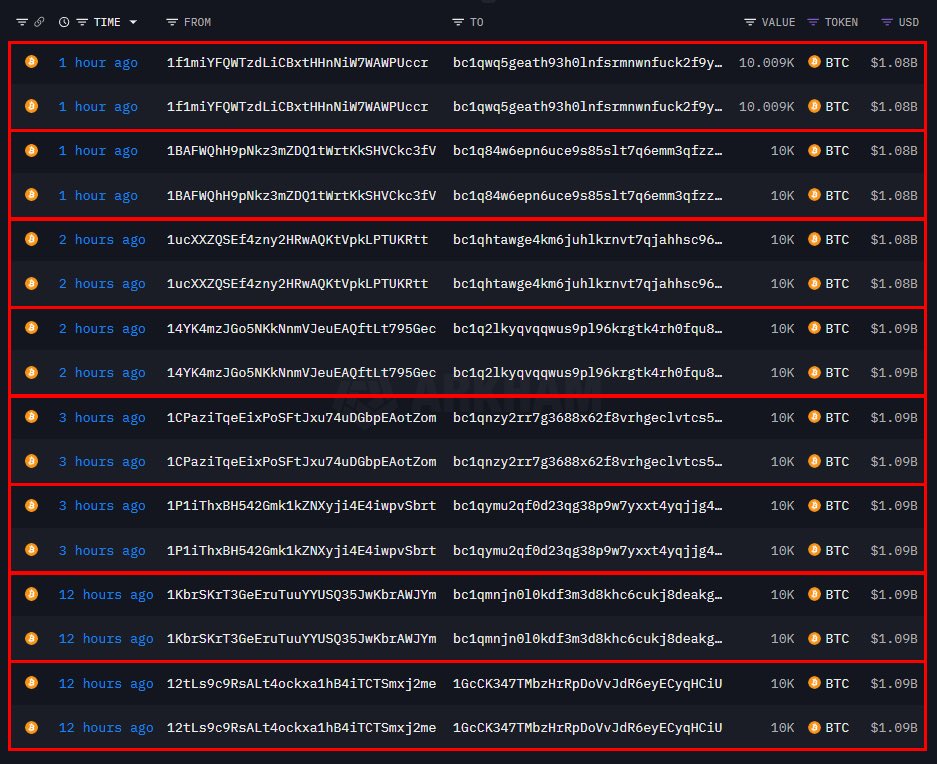

$8.6 Billion Awakening

Eight long-dormant Bitcoin wallets, untouched since 2011, collectively moved over $8.6 billion worth of BTC. Each wallet held exactly 10,000 BTC, acquired initially at dirt-cheap prices between $0.78 and $3.37, representing a staggering 137,179x return.

A single entity moved $8.6 BILLION of BTC from 8 addresses in the past day.

All of the Bitcoin was moved into the original wallets on either 2nd April or 4th May 2011 and has been held for over 14 years.

Currently, the Bitcoin is sitting in 8 new addresses and has not been… pic.twitter.com/nm53tVRzLJ

— Arkham (@arkham) July 4, 2025

What’s most concerning is the synchronized movement of these wallets, which hadn’t seen any activity for over 14 years. The sudden reappearance left investors questioning if this is coordinated profit-taking or state-level asset mobilization.

Coinbase’s Head of Product, Conor Grogan, even hinted that the transactions could be a result of a potential hack. The executive pointed to a suspicious Bitcoin Cash (BCH) test transaction conducted just hours before the BTC transfers.

If true (again, I'm speculating on straws here), this would be by far the largest heist in human history

— Conor (@jconorgrogan) July 4, 2025

Hackers often use similar techniques of probing to confirm access to private keys before making major moves.

“If true… this would be by far the largest heist in human history,” Grogan posted on X.

While Grogan’s theory adds further insight into the abnormal behavior, the fact that other BCH wallets tied to the same entity remain untouched has further fueled speculation.

Whale Exodus & Retail Influx

According to analyst Amr Taha, the July market structure suggests that whales may be exiting while retail investors pile in.

Entities holding over 10,000 BTC reportedly offloaded 12,000 BTC on July 3rd alone, with the 1,000–10,000 BTC cohort selling an additional 14,000 BTC since June 30. This distribution pattern often marks a local top or mid-cycle cooling.

Meanwhile, short-term holders, typically retail, have added 382,000 BTC to their portfolios in early July, signaling renewed optimism. Long-term holders, however, are trimming their exposure, a sign of profit booking at current prices.

Further, Binance Futures’ Open Interest has failed to break the $11.5 billion resistance level decisively, mirroring conditions seen on June 10th. The inability to sustain momentum on derivatives markets highlights that bears are at play.

Technical Outlook: MACD, RSI, and Fibonacci Levels

On the daily chart, Bitcoin’s MACD is in neutral territory — the signal and MACD lines are converging with no clear bullish crossover in sight, suggesting a pause in upward momentum.

Meanwhile, the RSI is at 54, reflecting indecision. Neither overbought nor oversold, the RSI hints at a wait-and-watch mood among traders.

BTC 1D Chart | Source: TradingView

More critically, Bitcoin is attempting breakout over the 0.786 Fibonacci retracement level ($107,964). The next key Fibonacci target lies at 1.618 ($118,185), and if bulls can reclaim momentum, a move toward $130K (2.618 level) or even $150K (4.236) is conceivable.

However, failure to hold above $107K could see Bitcoin revisit support near $101K (0.382 level) or even $98K (swing low).

If $107K holds and the macro backdrop remains favorable, bulls may yet charge toward the $118K–$130K range. But if sentiment deteriorates further, especially if the $8.6 billion transfer is confirmed to be malicious, a sharp correction could be imminent.next

The post Is Bitcoin Rally Over? $8B Wallet Hack, Holders Retreat appeared first on Coinspeaker.

812

0

coinpedia

The post 80,000 BTC Moved After 14 Years: Mystery Transfer or Massive Hack? appeared first on Coinpedia Fintech News

Something strange just happened in the Bitcoin world this week as nearly 80,000 Bitcoin, mined more than 14 years ago, suddenly moved across eight dormant wallets, making it the largest known transfer of so-called “Satoshi-era” BTC in history.

Now, experts are wondering: Was this a planned move, or could it be the biggest crypto hack ever?

Let’s break it down!

Old Satoshi-Era Coins Come Alive

On July 4, 2025, blockchain watchers were shocked to see 80,000 BTC transferred from eight wallets that had been inactive since 2011.

Two of them, each containing 20,000 BTC, were originally funded when Bitcoin was worth just $0.78 per coin. Meanwhile, today, each wallet now holds over $1.1 billion worth of BTC.

Interestingly, the coins haven’t been moved since reaching these new wallets, and no individual or company has claimed ownership. However, the sudden movement has raised immediate questions.

Who’s Behind the Transfer?

The on-chain analysis firm Arkham said all eight wallets seem to belong to one single entity. The BTC was sent to fresh wallets using newer, cheaper address formats.

Most of the coins didn’t go to exchanges, they just moved to new addresses. And this has raised concerns.

Now, the big question has arisen: Was this transfer legitimate, or was it a hack?

That’s what Conor Grogan, head of product at Coinbase, is wondering. In an X post, Grogan floated the idea that this could be the largest crypto heist in history if those wallets were compromised.

He pointed to one suspicious clue: a small Bitcoin Cash (BCH) transaction made from one of the whale wallets about 14 hours before the main BTC transfer. According to Grogan, this may have been a way to secretly test whether the wallet’s private keys still worked.

While, Grogan made it clear that this is just speculation, not proof. But he added, “If this really was a hack,” Grogan said, “it could be the biggest theft in

1.88K

0

Convert USD to BCH

Bitcoin Cash price performance in USD

The current price of Bitcoin Cash is $487.80. Over the last 24 hours, Bitcoin Cash has increased by +0.23%. It currently has a circulating supply of 19,893,087 BCH and a maximum supply of 21,000,000 BCH, giving it a fully diluted market cap of $9.69B. At present, Bitcoin Cash holds the 11 position in market cap rankings. The Bitcoin Cash/USD price is updated in real-time.

Today

+$1.1000

+0.22%

7 days

-$1.3000

-0.27%

30 days

+$103.90

+27.06%

3 months

+$212.30

+77.05%

Popular Bitcoin Cash conversions

Last updated: 07/06/2025, 09:13

| 1 BCH to USD | $487.10 |

| 1 BCH to PHP | ₱27,528.45 |

| 1 BCH to EUR | €413.54 |

| 1 BCH to IDR | Rp 7,892,093 |

| 1 BCH to GBP | £356.71 |

| 1 BCH to CAD | $663.06 |

| 1 BCH to AED | AED 1,789.13 |

| 1 BCH to VND | ₫12,747,972 |

About Bitcoin Cash (BCH)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Latest news about Bitcoin Cash (BCH)

$8B BTC Movements May Have Been Preceded by Covert Bitcoin Cash Test

Eight wallets that had been dormant since 2011 each transferred 10,000 BTC to new SegWit addresses on Friday, over 14 years after initially receiving bitcoin in what is now colloquially known as the network’s “Satoshi era.”

Jul 5, 2025|CoinDesk

Bitcoin Cash Surges 5%, Chalks Out Bullish Golden Cross Against BTC

The BCH/BTC pair has risen nearly 20% in four weeks, with a bullish golden crossover indicating potential for a bull market.

Jul 1, 2025|CoinDesk

CoinDesk 20 Performance Update: Bitcoin Cash (BCH) Gains 6.0%, Leading Index Higher

Solana (SOL) was also a top performer, rising 1.8% from Tuesday.

Jun 25, 2025|CoinDesk

Bitcoin Cash FAQ

What factors impact the Bitcoin Cash price?

The price of Bitcoin Cash directly correlates with the price of Bitcoin. Hence, any fall or rise in the latter causes a corresponding price action for the former. BCH price is also impacted by multiple factors, including the token's fixed supply, adoption efforts, and regulatory changes regarding cryptocurrencies.

What is the BCH price prediction?

While it’s challenging to predict the exact future price of BCH, you can combine various methods like technical analysis, market trends, and historical data to make informed decisions.

How can I securely store my BCH tokens?

We provide a multi-chain OKX Web3 Wallet with all OKX accounts that allows you to fully self-custody your tokens. You can store BCH or any other cryptocurrency for as long as needed. In addition, the OKX Web3 Wallet offers inbuilt access to hundreds of decentralized applications (DApps) and the OKX NFT Marketplace.

How much is 1 Bitcoin Cash worth today?

Currently, one Bitcoin Cash is worth $487.80. For answers and insight into Bitcoin Cash's price action, you're in the right place. Explore the latest Bitcoin Cash charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Bitcoin Cash, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Bitcoin Cash have been created as well.

Will the price of Bitcoin Cash go up today?

Check out our Bitcoin Cash price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Convert USD to BCH