XRP

XRP-pris

$2,2216

+$0,00070000

(+0,03 %)

Prisendring fra 00:00 UTC til nå

Ansvarsfraskrivelse

Det sosiale innholdet på denne siden («Innhold»), inkludert, men ikke begrenset til, tweets og statistikk levert av LunarCrush, er hentet fra tredjeparter og levert «som det er» kun for informasjonsformål. OKX garanterer ikke kvaliteten eller nøyaktigheten til innholdet, og innholdet representerer ikke synspunktene til OKX. Det er ikke ment å gi (i) investeringsråd eller anbefalinger, (ii) et tilbud eller oppfordring til å kjøpe, selge eller holde digitale ressurser, eller (iii) finansiell, regnskapsmessig, juridisk eller skattemessig rådgivning. Digitale ressurser, inkludert stablecoins og NFT-er, innebærer en høy grad av risiko, og kan variere mye. Prisen og ytelsen til den digitale ressursen er ikke garantert og kan endres uten varsel.

OKX gir ikke anbefalinger om investering eller aktiva. Du bør vurdere nøye om trading eller holding av digitale aktiva er egnet for deg i lys av din økonomiske situasjon. Rådfør deg med din juridiske / skatte- / investeringsprofesjonelle for spørsmål om dine spesifikke omstendigheter. For ytterligere detaljer, se våre vilkår for bruk og risikoadvarsel. Ved å bruke tredjepartsnettstedet («TPN») godtar du at all bruk av TPN vil være underlagt og styrt av vilkårene på TPN. Med mindre det er uttrykkelig angitt skriftlig, er OKX og dets partnere («OKX») ikke på noen måte knyttet til eieren eller operatøren av TPN. Du godtar at OKX ikke er ansvarlige for tap, skade eller andre konsekvenser som oppstår fra din bruk av TPN. Vær oppmerksom på at bruk av TNS kan føre til tap eller reduksjon av eiendelene dine. Produktet er kanskje ikke tilgjengelig i alle jurisdiksjoner.

OKX gir ikke anbefalinger om investering eller aktiva. Du bør vurdere nøye om trading eller holding av digitale aktiva er egnet for deg i lys av din økonomiske situasjon. Rådfør deg med din juridiske / skatte- / investeringsprofesjonelle for spørsmål om dine spesifikke omstendigheter. For ytterligere detaljer, se våre vilkår for bruk og risikoadvarsel. Ved å bruke tredjepartsnettstedet («TPN») godtar du at all bruk av TPN vil være underlagt og styrt av vilkårene på TPN. Med mindre det er uttrykkelig angitt skriftlig, er OKX og dets partnere («OKX») ikke på noen måte knyttet til eieren eller operatøren av TPN. Du godtar at OKX ikke er ansvarlige for tap, skade eller andre konsekvenser som oppstår fra din bruk av TPN. Vær oppmerksom på at bruk av TNS kan føre til tap eller reduksjon av eiendelene dine. Produktet er kanskje ikke tilgjengelig i alle jurisdiksjoner.

XRP markedsinformasjon

Markedsverdi

Markedsverdien beregnes ved å multiplisere det sirkulerende tilbudet av en mynt med den siste prisen.

Markedsverdi = Sirkulerende tilbud × Siste pris

Markedsverdi = Sirkulerende tilbud × Siste pris

Sirkulerende forsyning

Totalbeløpet for en mynt som er offentlig tilgjengelig på markedet.

Markedsverdirangering

En mynts rangering i form av markedsverdi.

Historisk toppnivå

Høyeste pris en mynt har nådd i sin handelshistorikk.

Historisk bunnivå

Laveste pris en mynt har nådd i sin handelshistorikk.

Markedsverdi

$131,17 mrd.

Sirkulerende forsyning

59 068 187 926 XRP

59,06 % av

100 000 000 000 XRP

Markedsverdirangering

--

Revisjoner

Siste revisjon: 16. aug. 2023, (UTC+8)

Høyeste pris siste 24 timer

$2,2440

Laveste pris siste 24 timer

$2,1975

Historisk toppnivå

$3,4040

−34,74 % (-$1,1824)

Sist oppdatert: 17. jan. 2025, (UTC+8)

Historisk bunnivå

$0,10370

+2 042,33 % (+$2,1179)

Sist oppdatert: 13. mars 2020, (UTC+8)

Hva føler du om XRP i dag?

Del følelsene dine her ved å gi en tommel opp hvis du føler deg optimistisk om mynten eller en tommel ned hvis du føler deg nedadgående.

Stem for å vise resultater

XRP-feed

Følgende innhold er hentet fra .

Marco Polo

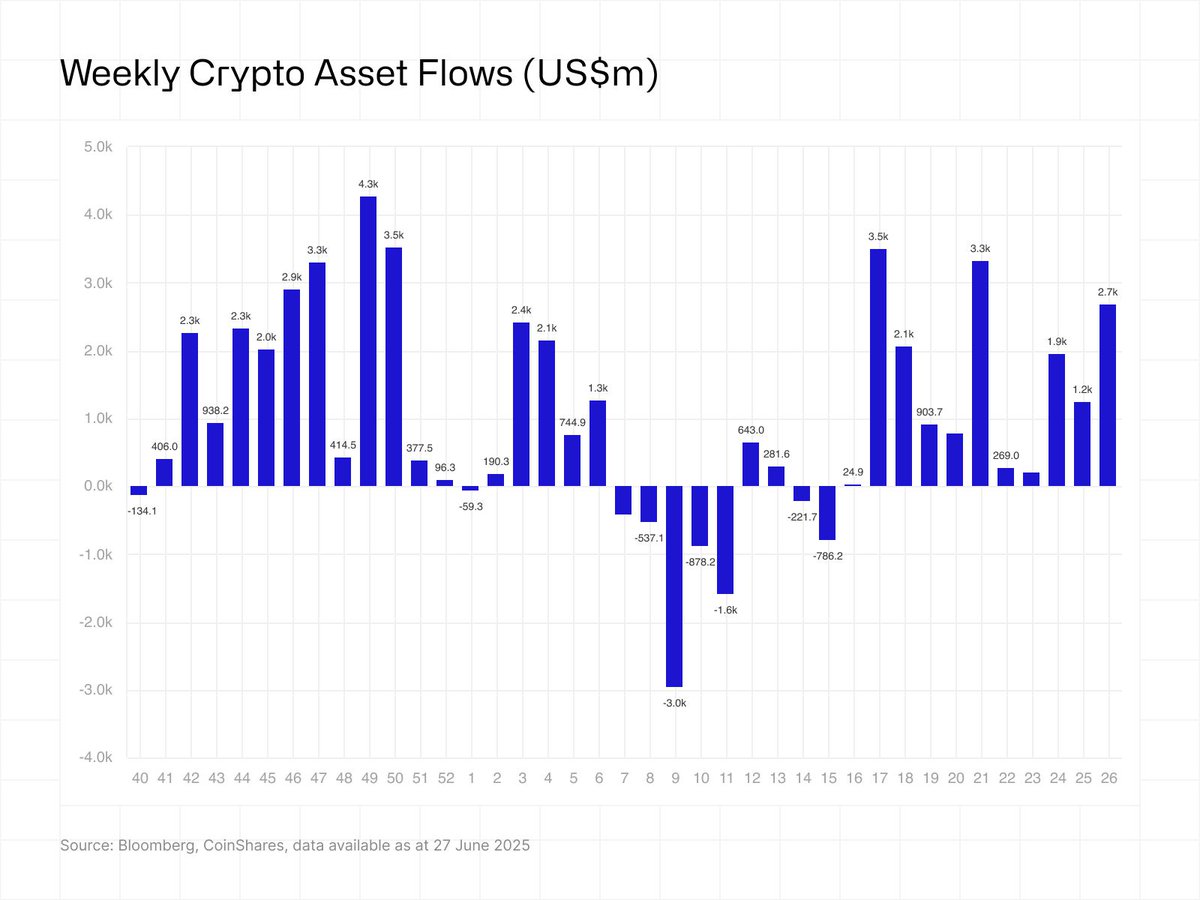

Digitale aktivafond registrerte nettopp 2,67 milliarder dollar i netto innstrømning denne uken, noe som bringer 2025 YTD-tilstrømning til 17,78 milliarder dollar.

Det markerer 11 uker på rad med positive tilstrømninger. Dette er den lengste rekken siden tidlig i 2021.

🟠 Bitcoin: 2,2 milliarder dollar

🔵 Ethereum: $ 429 millioner

🟢 XRP: $ 10.6 millioner

🟣 Solana: $ 5.3 millioner

USA alene bidro med 2,65 milliarder dollar, nesten hele den globale ukentlige totalen.

Korte Bitcoin-produkter postet 12 millioner dollar i utstrømninger hittil i år, dette viser at smarte penger fjerner nedsidespill.

Ingen ETF-kunngjøringer, ingen store katalysatorer, ingen støy, bare vedvarende allokering.

Slutten av året ser ut til å bli HUUGEE!

Vis originalen

9,66k

81

Konverter USD til XRP

XRP prisutvikling i USD

Gjeldende pris på XRP er $2,2216. Siden 00:00 UTC, XRP har økt ved +0,03 %. Den har for tiden en sirkulerende forsyning på 59 068 187 926 XRP og en maksimal forsyning på 100 000 000 000 XRP, noe som gir den en fullt utvannet markedsverdi på $131,17 mrd.. For tiden har XRP-mynten 0. plass i markedsverdirangeringen. XRP/USD-prisen oppdateres i sanntid.

I dag

+$0,00070000

+0,03 %

7 dager

+$0,031000

+1,41 %

30 dager

+$0,021800

+0,99 %

3 måneder

+$0,29980

+15,59 %

Populære XRP konverteringer

Sist oppdatert: 05.07.2025, 19:12

| 1 XRP til USD | 2,2207 $ |

| 1 XRP til EUR | 1,8854 € |

| 1 XRP til PHP | 125,50 ₱ |

| 1 XRP til IDR | 35 980,23 Rp |

| 1 XRP til GBP | 1,6262 £ |

| 1 XRP til CAD | 3,0229 $ |

| 1 XRP til AED | 8,1567 AED |

| 1 XRP til VND | 58 118,29 ₫ |

Om XRP (XRP)

Den oppgitte vurderingen er en samlet vurdering som OKX har samlet inn fra de oppgitte kildene, og er kun ment som informasjon. OKX garanterer ikke for kvaliteten eller nøyaktigheten av vurderingene. Denne aktiviteten er ikke ment å gi (i) investeringsråd eller en anbefaling, (ii) et tilbud eller oppfordring om å kjøpe, selge eller holde digitale ressurser, eller (iii) finansiell, regnskapsmessig, juridisk eller skattemessig rådgivning. Digitale ressurser, inkludert stablecoins og NFT-er, innebærer en høy grad av risiko, og verdien kan variere mye, og til og med verdiløs. Prisen og ytelsen til digitale ressurser er ikke garantert og kan endres uten varsel. De digital ressursene dine er ikke dekket av forsikring mot potensielle tap. Historisk avkastning er ikke en indikasjon på fremtidig avkastning. OKX garanterer ikke avkastning, tilbakebetaling av hovedstol eller renter. OKX gir ikke anbefalinger om investeringer eller aktiva. Du bør nøye overveie om trading eller holding digitale ressurser passer for deg i lys av din økonomiske situasjon. Rådfør deg med din advokat/skatte- eller investeringsekspert hvis du har spørsmål om dine spesifikke forhold.

Vis mer

- Offisiell nettside

- White Paper

- Github

- Blokkutforsker

Om tredjepartsnettsteder

Om tredjepartsnettsteder

Ved å bruke tredjepartsnettstedet ("TPW") godtar du at all bruk av TPW vil være underlagt og styrt av vilkårene i TPW. Med mindre det er uttrykkelig angitt skriftlig, er OKX og dets tilknyttede selskaper ("OKX") ikke på noen måte knyttet til eieren eller operatøren av TPW. Du godtar at OKX ikke er ansvarlig eller ansvarlig for tap, skade eller andre konsekvenser som oppstår fra din bruk av TPW. Vær oppmerksom på at bruk av en TPW kan føre til tap eller reduksjon av dine aktiva.

XRP Vanlige spørsmål

Hvor mye er 1 XRP verdt i dag?

For øyeblikket er en XRP verdt $2,2216. For svar og innsikt i prishandlingen til XRP, er du på rett sted. Utforsk de nyeste XRP diagrammene og trade ansvarlig med OKX.

Hva er kryptovaluta?

Kryptovalutaer, for eksempel XRP, er digitale eiendeler som opererer på en offentlig hovedbok kalt blokk-kjeder. Lær mer om mynter og tokens som tilbys på OKX og deres forskjellige attributter, som inkluderer live-priser og sanntidsdiagrammer.

Når ble kryptovaluta oppfunnet?

Takket være finanskrisen i 2008 økte interessen for desentralisert finans. Bitcoin tilbød en ny løsning ved å være en sikker digital ressurs på et desentralisert nettverk. Siden den gang har mange andre tokens som XRP blitt opprettet også.

Vil prisen på XRP gå opp i dag?

Ta en titt på vår XRP prisantydningsside for å forutsi fremtidige priser og bestemme prismålene dine.

ESG-erklæring

ESG-forskrifter (Environmental, Social, and Governance) for kryptoaktiva tar sikte på å adressere deres miljøpåvirkning (f.eks. energikrevende gruvedrift), fremme åpenhet og sikre etisk styringspraksis for å tilpasse kryptoindustrien med bredere bærekraft- og samfunnsmål. Disse forskriftene oppfordrer til overholdelse av standarder som reduserer risiko og fremmer tillit til digitale eiendeler.

Aktivadetaljer

Navn

OKCoin Europe Ltd

Relevant juridisk enhetsidentifikator

54930069NLWEIGLHXU42

Navn på kryptoaktiva

Ripple XRP

Konsensusmekanisme

Ripple XRP is present on the following networks: Binance Smart Chain, Klaytn, Ripple.

Binance Smart Chain (BSC) uses a hybrid consensus mechanism called Proof of Staked Authority (PoSA), which combines elements of Delegated Proof of Stake (DPoS) and Proof of Authority (PoA). This method ensures fast block times and low fees while maintaining a level of decentralization and security. Core Components 1. Validators (so-called “Cabinet Members”): Validators on BSC are responsible for producing new blocks, validating transactions, and maintaining the network’s security. To become a validator, an entity must stake a significant amount of BNB (Binance Coin). Validators are selected through staking and voting by token holders. There are 21 active validators at any given time, rotating to ensure decentralization and security. 2. Delegators: Token holders who do not wish to run validator nodes can delegate their BNB tokens to validators. This delegation helps validators increase their stake and improves their chances of being selected to produce blocks. Delegators earn a share of the rewards that validators receive, incentivizing broad participation in network security. 3. Candidates: Candidates are nodes that have staked the required amount of BNB and are in the pool waiting to become validators. They are essentially potential validators who are not currently active but can be elected to the validator set through community voting. Candidates play a crucial role in ensuring there is always a sufficient pool of nodes ready to take on validation tasks, thus maintaining network resilience and decentralization. Consensus Process 4. Validator Selection: Validators are chosen based on the amount of BNB staked and votes received from delegators. The more BNB staked and votes received, the higher the chance of being selected to validate transactions and produce new blocks. The selection process involves both the current validators and the pool of candidates, ensuring a dynamic and secure rotation of nodes. 5. Block Production: The selected validators take turns producing blocks in a PoA-like manner, ensuring that blocks are generated quickly and efficiently. Validators validate transactions, add them to new blocks, and broadcast these blocks to the network. 6. Transaction Finality: BSC achieves fast block times of around 3 seconds and quick transaction finality. This is achieved through the efficient PoSA mechanism that allows validators to rapidly reach consensus. Security and Economic Incentives 7. Staking: Validators are required to stake a substantial amount of BNB, which acts as collateral to ensure their honest behavior. This staked amount can be slashed if validators act maliciously. Staking incentivizes validators to act in the network's best interest to avoid losing their staked BNB. 8. Delegation and Rewards: Delegators earn rewards proportional to their stake in validators. This incentivizes them to choose reliable validators and participate in the network’s security. Validators and delegators share transaction fees as rewards, which provides continuous economic incentives to maintain network security and performance. 9. Transaction Fees: BSC employs low transaction fees, paid in BNB, making it cost-effective for users. These fees are collected by validators as part of their rewards, further incentivizing them to validate transactions accurately and efficiently.

Klaytn employs a modified Istanbul Byzantine Fault Tolerance (IBFT) consensus algorithm, a variant of Proof of Authority (PoA), enabling high performance and immediate transaction finality. Core Components of Klaytn’s Consensus: 1. Modified IBFT Algorithm: Immediate Transaction Finality: Klaytn’s IBFT algorithm ensures that once a block is validated, it is immediately final and cannot be reversed. This guarantees that transactions are quickly settled, providing a secure and efficient user experience. 2. Klaytn Governance Council: Council-Driven Governance: The Klaytn network is governed by the Klaytn Governance Council, a consortium of global organizations responsible for selecting and maintaining Consensus Nodes (CNs). This council-based governance model balances decentralization with performance and ensures transparency in decision-making. Two-Thirds Majority for Finalization: For a block to be finalized, it must receive signatures from more than two-thirds of the council members, ensuring broad consensus and network security. 3. Three-Tiered Node Architecture: Consensus Nodes (CNs): The selected validators responsible for producing and validating blocks. CNs are at the core of the network’s security and stability. Proxy Nodes (PNs): Act as intermediaries, relaying data between CNs and the broader network, which helps distribute network traffic and improve accessibility. Endpoint Nodes (ENs): Interface directly with end-users, facilitating transactions, executing smart contracts, and serving as user access points to the Klaytn network.

The Ripple blockchain, specifically the XRP Ledger (XRPL), uses a consensus mechanism known as the Ripple Protocol Consensus Algorithm (RPCA). It differs from Proof of Work (PoW) and Proof of Stake (PoS) as it doesn't rely on mining or staking but instead leverages trusted validators in a Federated Byzantine Agreement (FBA) model. Core Concepts: 1. Validators and Unique Node Lists (UNL): Validators are trusted nodes in the network that validate transactions and propose new ledger updates. Each node maintains a list of trusted validators known as its Unique Node List (UNL). Consensus is achieved when 80% of the validators in a node's UNL agree on the validity of a transaction or block. This ensures high levels of security and decentralization. 2. Transaction Ordering and Validation: Transactions are broadcast to validators, and once 80% of the validators agree, the transaction is considered confirmed. Each ledger in the XRPL contains transaction data, and validators ensure the validity and proper ordering of these transactions. Consensus Process: 1. Proposal Phase: Validators propose new transactions to be added to the ledger. 2. Validation Phase: Validators vote on proposed transactions by comparing them to their UNL. Consensus is achieved when 80% of validators agree. 3. Finalization: Once consensus is reached, the transactions are written into the new ledger, making them irreversible and final.

Insentivmekanismer og gjeldende gebyrer

Ripple XRP is present on the following networks: Binance Smart Chain, Klaytn, Ripple.

Binance Smart Chain (BSC) uses the Proof of Staked Authority (PoSA) consensus mechanism to ensure network security and incentivize participation from validators and delegators. Incentive Mechanisms 1. Validators: Staking Rewards: Validators must stake a significant amount of BNB to participate in the consensus process. They earn rewards in the form of transaction fees and block rewards. Selection Process: Validators are selected based on the amount of BNB staked and the votes received from delegators. The more BNB staked and votes received, the higher the chances of being selected to validate transactions and produce new blocks. 2. Delegators: Delegated Staking: Token holders can delegate their BNB to validators. This delegation increases the validator's total stake and improves their chances of being selected to produce blocks. Shared Rewards: Delegators earn a portion of the rewards that validators receive. This incentivizes token holders to participate in the network’s security and decentralization by choosing reliable validators. 3. Candidates: Pool of Potential Validators: Candidates are nodes that have staked the required amount of BNB and are waiting to become active validators. They ensure that there is always a sufficient pool of nodes ready to take on validation tasks, maintaining network resilience. 4. Economic Security: Slashing: Validators can be penalized for malicious behavior or failure to perform their duties. Penalties include slashing a portion of their staked tokens, ensuring that validators act in the best interest of the network. Opportunity Cost: Staking requires validators and delegators to lock up their BNB tokens, providing an economic incentive to act honestly to avoid losing their staked assets. Fees on the Binance Smart Chain 5. Transaction Fees: Low Fees: BSC is known for its low transaction fees compared to other blockchain networks. These fees are paid in BNB and are essential for maintaining network operations and compensating validators. Dynamic Fee Structure: Transaction fees can vary based on network congestion and the complexity of the transactions. However, BSC ensures that fees remain significantly lower than those on the Ethereum mainnet. 6. Block Rewards: Incentivizing Validators: Validators earn block rewards in addition to transaction fees. These rewards are distributed to validators for their role in maintaining the network and processing transactions. 7. Cross-Chain Fees: Interoperability Costs: BSC supports cross-chain compatibility, allowing assets to be transferred between Binance Chain and Binance Smart Chain. These cross-chain operations incur minimal fees, facilitating seamless asset transfers and improving user experience. 8. Smart Contract Fees: Deployment and Execution Costs: Deploying and interacting with smart contracts on BSC involves paying fees based on the computational resources required. These fees are also paid in BNB and are designed to be cost-effective, encouraging developers to build on the BSC platform.

Klaytn’s incentive structure includes block rewards and transaction fees distributed to Consensus Nodes (CNs) and various network funds, fostering network security, sustainability, and community development. Incentive Mechanisms: 1. Rewards for Consensus Nodes (CNs): Fixed Block Rewards: CNs earn fixed rewards in KLAY tokens for validating and producing blocks. This predictable income incentivizes CNs to maintain active participation and secure the network. Transaction Fees: Users pay transaction fees in KLAY tokens, which are collected by the network and distributed among the CNs as additional rewards, further supporting network security and stability. 2. Block Reward Distribution: Governance Council (GC) Reward: GC Block Proposer Reward: 10% of the block reward goes to the specific CN that proposed the block, incentivizing continuous active participation. GC Staking Award: 40% of the block reward is distributed among all Governance Council members who stake KLAY, promoting network security by rewarding staked tokens. Klaytn Community Fund (KCF): 30% of each block reward is allocated to the KCF to support community development, dApp creation, and overall ecosystem growth. Klaytn Foundation Fund (KFF): 20% of the block reward goes to the KFF, providing resources for long-term network sustainability and future development initiatives. 3. Transaction Fees: User Fees for Network Interaction: Users pay fees in KLAY based on gas usage and gas price for transactions. These fees are then distributed to CNs, incentivizing efficient transaction processing and active participation. Applicable Fees: Transaction Fees: Transaction fees on Klaytn are paid in KLAY and calculated based on gas consumption. These fees support network maintenance by compensating validators and fostering economic sustainability.

The Ripple XRP blockchain uses a unique incentive structure that differs from traditional Proof of Work (PoW) or Proof of Stake (PoS) systems, focusing on its Ripple Protocol Consensus Algorithm (RPCA). Here's a breakdown of the incentives and fees: Incentive Mechanisms to Secure Transactions: 1. Validators: Validators on the Ripple network are not directly compensated with rewards like in PoW/PoS models. Instead, they are incentivized by the utility and stability of the network, particularly financial institutions that benefit from Ripple's efficiency in cross-border payments. 2. No Mining: Since Ripple does not use mining, it eliminates the need for energy-intensive computations, contributing to fast transaction speeds and scalability. Fees on the Ripple XRP Blockchain: 1. Transaction Fees: Ripple charges minimal transaction fees (typically fractions of an XRP, known as "drops") for each transaction. The purpose of these fees is to prevent network spam and overload. 2. Burn Mechanism: A portion of each transaction fee is burned, meaning it's permanently removed from circulation. This reduces the overall supply of XRP over time, contributing to potential long-term value stability.

Starten på perioden som erklæringen gjelder for

2024-07-04

Slutten på perioden som erklæringen gjelder for

2025-07-04

Energirapport

Energiforbruk

299632.45133 (kWh/a)

Fornybar energiforbruk

27.719919728 (%)

Energiintensitet

0.00001 (kWh)

Viktige energikilder og metodologier

To determine the proportion of renewable energy usage, the locations of the nodes are to be determined using public information sites, open-source crawlers and crawlers developed in-house. If no information is available on the geographic distribution of the nodes, reference networks are used which are comparable in terms of their incentivization structure and consensus mechanism. This geo-information is merged with public information from Our World in Data, see citation. The intensity is calculated as the marginal energy cost wrt. one more transaction.

Ember (2025); Energy Institute - Statistical Review of World Energy (2024) - with major processing by Our World in Data. “Share of electricity generated by renewables - Ember and Energy Institute” [dataset]. Ember, “Yearly Electricity Data Europe”; Ember, “Yearly Electricity Data”; Energy Institute, “Statistical Review of World Energy” [original data]. Retrieved from https://ourworldindata.org/grapher/share-electricity-renewables.

Energiforbrukskilder og metodologier

The energy consumption of this asset is aggregated across multiple components:

For the calculation of energy consumptions, the so called 'bottom-up' approach is being used. The nodes are considered to be the central factor for the energy consumption of the network. These assumptions are made on the basis of empirical findings through the use of public information sites, open-source crawlers and crawlers developed in-house. The main determinants for estimating the hardware used within the network are the requirements for operating the client software. The energy consumption of the hardware devices was measured in certified test laboratories. When calculating the energy consumption, we used - if available - the Functionally Fungible Group Digital Token Identifier (FFG DTI) to determine all implementations of the asset of question in scope and we update the mappings regulary, based on data of the Digital Token Identifier Foundation. The information regarding the hardware used and the number of participants in the network is based on assumptions that are verified with best effort using empirical data. In general, participants are assumed to be largely economically rational. As a precautionary principle, we make assumptions on the conservative side when in doubt, i.e. making higher estimates for the adverse impacts.

To determine the energy consumption of a token, the energy consumption of the network(s) binance_smart_chain, klaytn is calculated first. For the energy consumption of the token, a fraction of the energy consumption of the network is attributed to the token, which is determined based on the activity of the crypto-asset within the network. When calculating the energy consumption, the Functionally Fungible Group Digital Token Identifier (FFG DTI) is used - if available - to determine all implementations of the asset in scope. The mappings are updated regularly, based on data of the Digital Token Identifier Foundation. The information regarding the hardware used and the number of participants in the network is based on assumptions that are verified with best effort using empirical data. In general, participants are assumed to be largely economically rational. As a precautionary principle, we make assumptions on the conservative side when in doubt, i.e. making higher estimates for the adverse impacts.

Utslippsrapport

Omfang 1 DLT GHG-utslipp – kontrollert

0.00000 (tCO2e/a)

Omfang 2 DLT GHG-utslipp – kjøpt

100.37853 (tCO2e/a)

GHG-intensitet

0.00000 (kgCO2e)

Viktige GHG-kilder og metodologier

To determine the GHG Emissions, the locations of the nodes are to be determined using public information sites, open-source crawlers and crawlers developed in-house. If no information is available on the geographic distribution of the nodes, reference networks are used which are comparable in terms of their incentivization structure and consensus mechanism. This geo-information is merged with public information from Our World in Data, see citation. The intensity is calculated as the marginal emission wrt. one more transaction.

Ember (2025); Energy Institute - Statistical Review of World Energy (2024) - with major processing by Our World in Data. “Carbon intensity of electricity generation - Ember and Energy Institute” [dataset]. Ember, “Yearly Electricity Data Europe”; Ember, “Yearly Electricity Data”; Energy Institute, “Statistical Review of World Energy” [original data]. Retrieved from https://ourworldindata.org/grapher/carbon-intensity-electricity Licenced under CC BY 4.0.

Konverter USD til XRP

Sosialt