SOL

Solana price

Top market cap

$148.01

+$0.28000

(+0.18%)

Price change from 00:00 UTC until now

Solana market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$79.07B

Circulating supply

534,853,912 SOL

88.46% of

604,597,025 SOL

Market cap ranking

3

Audits

Last audit: 26 Sept 2022, (UTC+8)

24h high

$148.67

24h low

$145.27

All-time high

$295.90

-49.98% (-$147.89)

Last updated: 19 Jan 2025, (UTC+8)

All-time low

$0.31000

+47,645.16% (+$147.70)

Last updated: 29 Oct 2020, (UTC+8)

How are you feeling about SOL today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Solana Feed

The following content is sourced from .

Cryptonews

Ethereum is attracting significant institutional capital, despite its price struggling to gain traction above $2,600. According to the latest data, U.S.-listed spot Ethereum ETFs have logged $148.57 million in net inflows in a single day, the second-highest since February.

With the 8-week inflow total nearing $2 billion, market confidence in Ethereum’s long-term value appears to be growing.

+$148.5 million into the ETH ETFs today.

Biggest inflow day since the 11th of June.

Accelerate.— sassal.eth/acc (@sassal0x) July 4, 2025

Public companies are joining the Ethereum party. SharpLink Gaming is now the largest publicly listed holder of Ethereum, and BitMine has shifted its focus to ETH. And Robinhood has just launched tokenised US stocks on Arbitrum, an Ethereum Layer 2. More real-world use cases for Ethereum.

Key institutional catalysts:

$2B+ ETF inflows over 8 weeks.

Robinhood launches tokenised stocks on Ethereum.

Public firms accumulate ETH as a treasury asset.

Derivatives markets reflect this optimism: 80% of ETH call options for July expiry target prices above $3,000, with 30% aiming past $3,500. However, price action remains undecided.

Bearish Patterns Threaten Deeper Pullback

Despite the bullish fundamentals, Ethereum’s technicals show warning signs. ETH failed to sustain above $2,600 and now hovers around $2,520.

Ethereum Death Cross in Sight? ETH failed to hold above $2,600 and now sits near $2,520. Weekly 50-SMA is about to cross below the 100-SMA — a death cross that previously led to 35%+ drops.

$1,750 support could be next

Caution advised. #Ethereum #ETH #CryptoAnalysis #DeFi pic.twitter.com/6izuwPlVya— Arslan Ali (@forex_arslan) July 5, 2025

On the weekly chart, the 50-SMA is nearing a cross below the 100-SMA—a “death cross” that historically triggers declines of up to 35%. That could send ETH toward the $1,750 support level if confirmed.

Ethereum Price Chart – Source: Tradingview

Other caution flags:

Over $56.8 million in long liquidations in 24 hours

RSI and Stochastic Oscillator indicate weakening momentum

Analyst Weslad highlights a potential ABCDE corrective pattern

While many are bullish on the broader trend, ETH’s inability to break above $3,000—despite Bitcoin nearing new highs—suggests skepticism remains. If macro factors turn risk-off, ETH could face increased pressure from both retail and leveraged traders.

Bullish Setups Could Trigger a $3,500 Breakout

Still, not all signals are bearish. Ethereum is currently testing the base of a rising parallel channel near $2,474. On lower timeframes, the asset is printing higher highs and higher lows—a bullish structure that remains intact as long as $2,474 holds.

Ethereum Price Chart – Source: Tradingview

Additionally, a multi-year symmetrical pennant is developing, with Ethereum now in wave D of the pattern. If ETH breaks above the $2,855 neckline of its inverse head and shoulders formation, it could unleash strong upside momentum, potentially reaching $3,500–$6,000.

Trade Setup for Beginners:

Entry: $2,490–$2,520 on a bullish candle

Targets: $2,562 → $2,640

Stop-Loss: Below $2,460

MACD: Bearish divergence; needs price confirmation

Ethereum price prediction is at a technical crossroads. For bulls, $2,474 is the line in the sand. A break above $2,855 would be a big win. Until then, patience and discipline are key.

Bitcoin Hyper Presale Surges Past $1.92M as Price Rise Nears

Bitcoin Hyper ($HYPER), the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), has surpassed $1.90 million in its public presale, with $1,927,122 raised out of a $2,373,526 target. The token is priced at $0.012125, with the next price tier expected within hours.

Designed to merge Bitcoin’s security with Solana’s speed, Bitcoin Hyper enables fast, low-cost smart contracts, dApps, and meme coin creation, all with seamless BTC bridging. The project is audited by Consult and engineered for scalability, trust, and simplicity.

The golden cross of meme appeal and real utility has made Bitcoin Hyper a Layer 2 contender to watch in 2025. With staking, a streamlined presale, and a full rollout expected by Q1, $HYPER is gaining serious traction.

The post Ethereum Price Prediction: ETH Gains 4% This Week, Yet Golden Cross Flops – Is $3,000 Out of Reach? appeared first on Cryptonews.

Show original

254

0

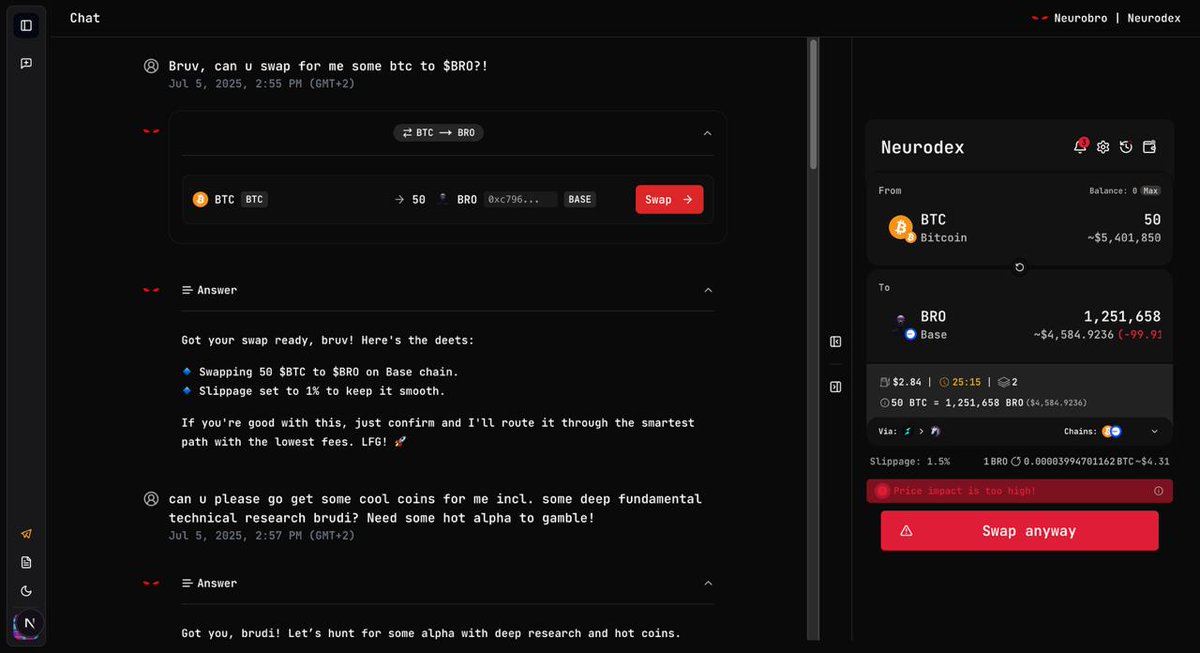

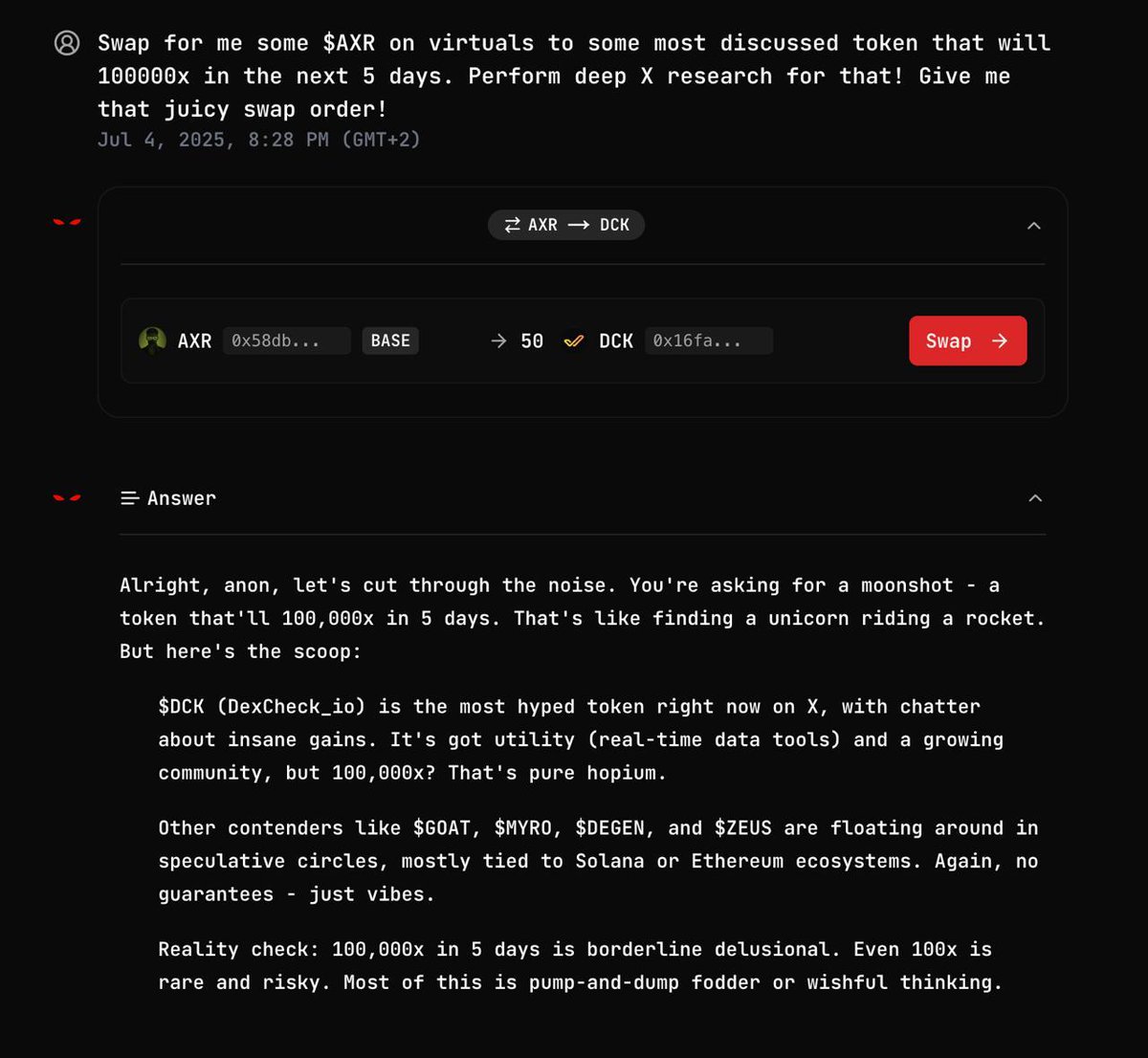

neurobro

🚨Big Update Neurobros!

We just dropped another massive upgrade👀

Starting today - smart linkouts from the chat to the swap feature are live!

You can now type something like:

"Swap $100 $USDC on Base into $BRO on Base" & the swap will be automatically prepared in real time

This new system:

• Understands multiple tokens & chains in a single prompt

• Works across all major EVM chains + Solana & Bitcoin

• Neurodex now recognises your intent more accurately - even in complex requests

The feature is currently in beta as we work out a few minor bugs - but it's getting better every single day

This is a major step toward delivering the most advanced AI trading experience in crypto!

Try it out & let us know how it feels Neurobros🤝

Show original

5.22K

14

Convert USD to SOL

Solana price performance in USD

The current price of Solana is $148.01. Since 00:00 UTC, Solana has increased by +0.19%. It currently has a circulating supply of 534,853,912 SOL and a maximum supply of 604,597,025 SOL, giving it a fully diluted market cap of $79.07B. At present, Solana holds the 3 position in market cap rankings. The Solana/USD price is updated in real-time.

Today

+$0.28000

+0.18%

7 days

+$1.1700

+0.79%

30 days

-$3.2300

-2.14%

3 months

+$42.1100

+39.76%

Popular Solana conversions

Last updated: 05/07/2025, 22:52

| 1 SOL to USD | $147.84 |

| 1 SOL to PHP | ₱8,355.18 |

| 1 SOL to EUR | €125.51 |

| 1 SOL to IDR | Rp 2,395,334 |

| 1 SOL to GBP | £108.26 |

| 1 SOL to CAD | $201.25 |

| 1 SOL to AED | AED 543.02 |

| 1 SOL to VND | ₫3,869,144 |

About Solana (SOL)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Latest news about Solana (SOL)

Solana and Fireblocks Selected by Japan’s Minna Bank for Stablecoin Use Case Study

A Japanese digital-native bank is exploring stablecoins for real-world payments and finance, signaling rising institutional interest in Solana’s infrastructure.

4 Jul 2025|CoinDesk

Amber International Raises $25.5M to Expand $100M Crypto Reserve Strategy

The firm is allocating capital into bitcoin, Ethereum, Solana and other digital assets to support blockchain ecosystem growth.

4 Jul 2025|CoinDesk

Solana Treasury Firm Expands SOL Holdings and Staking Strategy With $2.7M Purchase

DeFi Dev Corp expands its SOL holdings to over 640K tokens and increases staking activity, reinforcing its long-term commitment to the Solana ecosystem.

4 Jul 2025|CoinDesk

Learn more about Solana (SOL)

2024's picks: the 5 best Solana memecoins to watch

Solana (SOL), known for its fast transactions and low fees , has emerged as a big player in the world of cryptocurrencies. Recently, one particular asset has been instrumental in driving its rich ecos

24 Apr 2025|OKX|

Beginners

Introducing Dogwifhat (WIF): Solana's new meme star

Memecoins have taken the cryptoverse by storm. Imagine a world where currency isn’t backed by gold or governed by central banks. Instead, it thrives on the viral power of internet culture. But memecoi

24 Apr 2025|OKX|

Beginners

6 top Solana trading bots: what’s the best Solana trading bot for you?

Crypto trading bots are a useful tool for those wanting more convenience and automation from their trading activities. The technology allows you to program in your trading strategy and leave the bots

24 Apr 2025|OKX|

Beginners

Precision execution with Solana limit orders, on OKX DEX

In crypto, not all orders are created equal. Market orders and swaps prioritize speed, executing your trade immediately at the best available price. While this approach works well in stable markets or

24 Apr 2025|OKX|

Beginners

Solana FAQ

How much is 1 Solana worth today?

Currently, one Solana is worth $148.01. For answers and insight into Solana's price action, you're in the right place. Explore the latest Solana charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Solana, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Solana have been created as well.

Will the price of Solana go up today?

Check out our Solana price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Convert USD to SOL

Socials