USDT

Tether price

$1.0003

-$0.00001

(-0.01%)

Price change for the last 24 hours

Tether market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$158.66B

Circulating supply

158,596,591,635 USDT

100.00% of

158,596,591,635 USDT

Market cap ranking

--

Audits

Last audit: 1 Apr 2019, (UTC+8)

24h high

$1.0003

24h low

$1.0000

All-time high

$1.0130

-1.26% (-$0.01270)

Last updated: 13 Mar 2023, (UTC+8)

All-time low

$0.95145

+5.13% (+$0.048810)

Last updated: 12 May 2022, (UTC+8)

How are you feeling about USDT today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Tether Feed

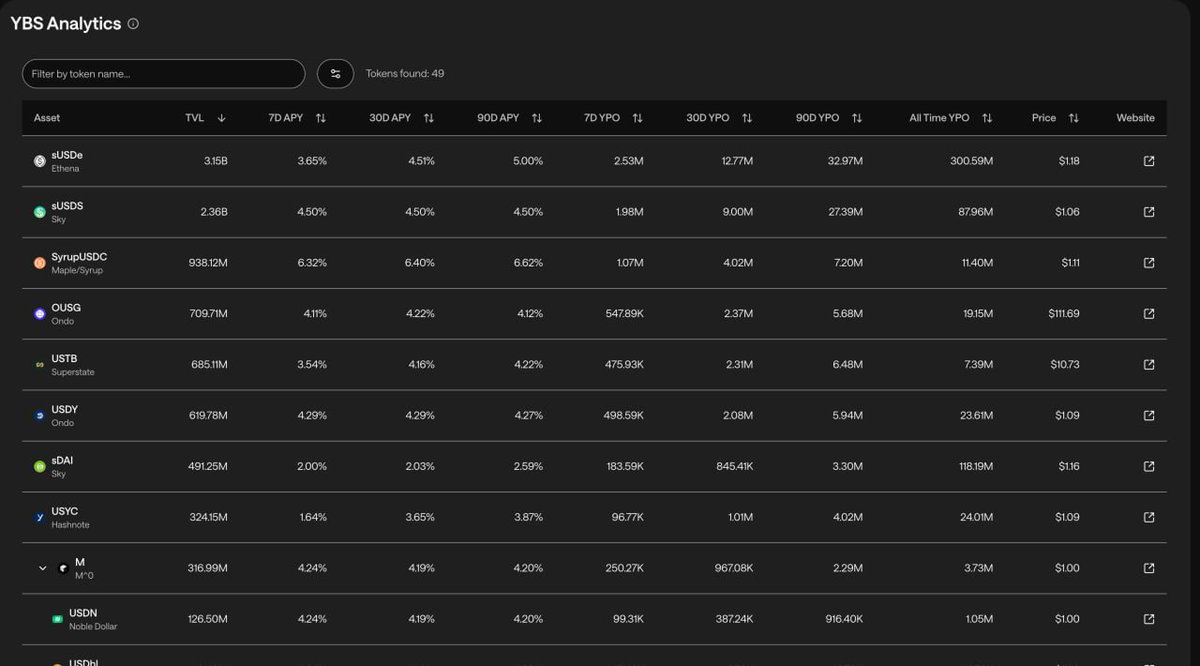

The following content is sourced from .

hanjay.eth.sol 🐻⛓

got a product idea that can serve normies entering crypto

make it really easy and simple: a plain interface wallet integrating with users' bank accounts. any amount of m1 money staying in the wallet in a custodial manner is converted into ybs earning yields. in the backend, the system can switch to the ybs paying the highest. it just looks like a use case of 'earning native yield on your usd or whatever your national fiat is'

not sure if there's anyone building such things?

Show original

3.17K

0

Leafswan

By the end of 2025, over 60% of whatever crypto you hold should be in stable coin.

Why did I say so? Because once again, people will be drunk in the unbelievable of their crypto backs, and they'll forget to take profit.

This shouldn't be you.

By the end of 2025, stables should be your best friend. You can choose stable coin YIELD farming protocols if you want to earn while keeping your money. I'll take about this later in the post.

However, many are doubting that we will have a pump soon. Yes, that's how it should be. If crypto was easy, everyone will be rich, but guess what? Crypto only rewards conviction.

I understand that it looks bleak at the moment and this doesn't look likely, but in the next one or two months, we're going to be experiencing some fireworks and many coins will hit 10 to 20X. For me, I speculate 8k for Ethereum, and 140k peak price for BTC. The US feds are going to be cutting rates after the September meeting, which means OCTOBER and November are going to be electric for alt coins.

You must understand that this current crypto cycle looks like this because retail has chosen to invest on meme coins, rather than go for the utility coins they're known to choose, however this isn't enough catalyst to keep the alt market down. We had COVID which was a black swan even in the last cycle, but the market still pumped.

Let me tell you one thing that'll pump the market again; FOMO. very soon done people will begin to chase gain, buying at the top when they should have held what they had, and this people will sadly become exit liquidity.

Again, by November/December, over 60% of your coin should already be in stable coins, and even if you still want to play with the market, or at least in BTC. However, any money you have in BTC should be out by at least January 2026.

Before then, you can choose protocols like @Lombard_Finance where you get to deposit your BTC and earn YIELDS for them. This way you can still participate in the market.

If you're too scared of holding BTC by then (which you should) then you can choose @multiplifi an automated protocol that helps you earn yield when you deposit USDT. you don't need to do anything, just deposit, and let your stable coin yield money, on a 5.39% APY.

I repeat you should be out of the market by 2026 December. Don't be the "500k BTC" or "send it higher" guy. You'll lose..

Show original2.42K

29

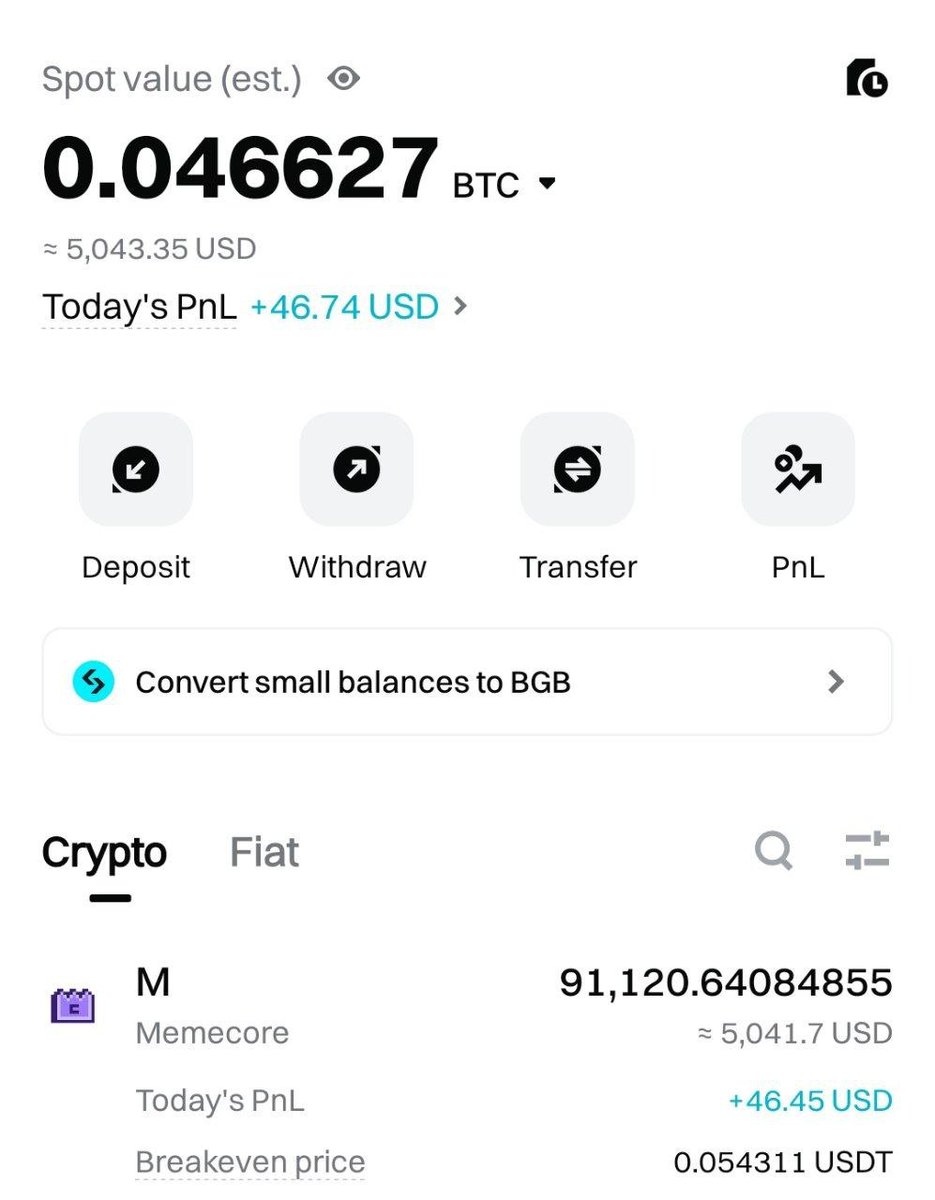

CEN

Meme core is skyrocketing, let's go!

@MemeX_MRC20

CEN

Right now @MemeX_MRC20 is bouncing back.

I only bought it at market price for $5,000, but it's going up.

The reason I bought it is that I saw a post from @Wanamaker_X and immediately wanted to stake it.

There's really no specific reason, and in the end, it's one of two outcomes: it could either crash or thrive, but honestly, I'm seeing it as an 80% chance of crashing versus a 20% chance of thriving.

Anyway, I'm just a crazy alt long holder, so instead of losing on futures, I just bought it. There's really no reason.

1.36K

55

Convert USD to USDT

Tether price performance in USD

The current price of Tether is $1.0003. Over the last 24 hours, Tether has increased by +0.00%. It currently has a circulating supply of 158,596,591,635 USDT and a maximum supply of 158,596,591,635 USDT, giving it a fully diluted market cap of $158.66B. At present, Tether holds the 0 position in market cap rankings. The Tether/USD price is updated in real-time.

Today

-$0.00001

-0.01%

7 days

-$0.00044

-0.05%

30 days

-$0.00034

-0.04%

3 months

+$0.00086000

+0.08%

Popular Tether conversions

Last updated: 06/07/2025, 01:36

| 1 USDT to USD | $1.0003 |

| 1 USDT to PHP | ₱56.4647 |

| 1 USDT to EUR | €0.84922 |

| 1 USDT to IDR | Rp 16,203.79 |

| 1 USDT to GBP | £0.73319 |

| 1 USDT to CAD | $1.3604 |

| 1 USDT to AED | AED 3.6710 |

| 1 USDT to VND | ₫26,001.04 |

About Tether (USDT)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Latest news about Tether (USDT)

Tether to Mine Bitcoin With Adecoagro in Brazil Using Surplus Renewable Energy

The project aims to monetize surplus energy and potentially add BTC to Adecoagro’s balance sheet.

3 Jul 2025|CoinDesk

NY Bankruptcy Judge Gives Celsius the Green Light to Pursue $4.3B Lawsuit Against Tether

Celsius has accused Tether of improperly liquidating nearly 40,000 bitcoins in order to cover an outstanding loan while it was on the precipice of bankruptcy in 2022.

3 Jul 2025|CoinDesk

Tether Seeks More Active Role at Juventus After Buying Over 10% of Soccer Club

Tether said it asked to participate in the club's recent capital increase and be granted a board seat in May.

26 Jun 2025|CoinDesk

Learn more about Tether (USDT)

What is aUSDT: exploring Tether's gold-backed synthetic dollar

June 2024 saw Tether, the platform behind the USDT stablecoin , launch Alloy (aUSDT), an over-collateralized digital asset backed by Tether Gold (XAUt). The asset provides more gold collateral than th

24 Apr 2025|OKX|

Beginners

What is USDT? Understanding the Tether stablecoin

USDT, also known as Tether, is a stablecoin that's pegged to the value of the US dollar. It operates on multiple blockchain networks, including Ethereum (ETH) , Tron (TRX) , Algorand (ALGO) , Solana (

24 Apr 2025|OKX|

Beginners

Tether's Strategic Gold Acquisition: Strengthening Digital Asset Backing

Tether Gold Acquisition: A Strategic Move to Bolster Digital Asset Ecosystem Tether, the issuer of the world’s largest stablecoin USDT, has made headlines with its acquisition of a 31.9% stake in Elem

15 Jun 2025|OKX

Tether's Open-Source Wallet Kit Aims to Revolutionize Non-Custodial Crypto Access

Tether Introduces Wallet Development Kit for Non-Custodial Crypto Solutions Tether, the company behind the world’s largest stablecoin, has announced a groundbreaking initiative to expand access to non

29 May 2025|OKX

Tether FAQ

How much is 1 Tether worth today?

Currently, one Tether is worth $1.0003. For answers and insight into Tether's price action, you're in the right place. Explore the latest Tether charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Tether, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Tether have been created as well.

Will the price of Tether go up today?

Check out our Tether price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Convert USD to USDT

Socials